Others, nevertheless, might still be qualified for assistance if they failed to take full benefit of the relief provisions in previous years. Typically, organizations were qualified for the refundable staff member retention tax credit (ERTC) if their service operations were suspended in 2020 or 2021, if they sustained a specific level of income loss or if they qualified as a recovery startup service after Feb.

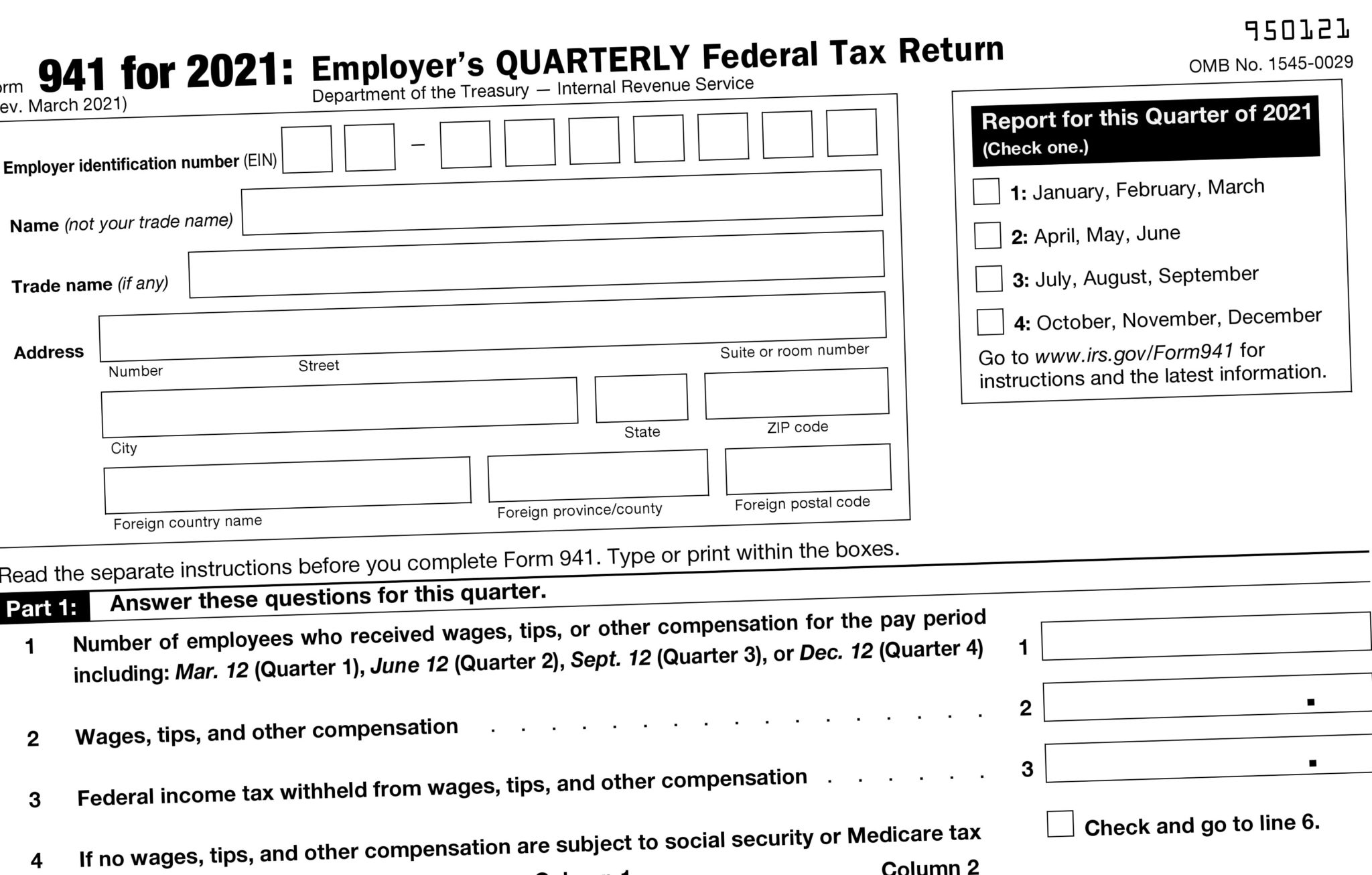

The rules for claiming the ERTC were broadened considerably in 2021, meaning that some small-business clients might not have actually benefited from the relief. Did you see this? 's still possible for those customers to submit modified payroll income tax return so it's important to fully comprehend the rules to make sure clients are getting the total they are worthy of.

![ERTC REFUND DEADLINE: How to get ERTC Tax Credit 2021 [ERC 2020] IRC ERC Tax Credit [File Form 941x] - YouTube](https://static.wixstatic.com/media/f8aa5d_b78e0bd012744891a645d6ded4f19e91~mv2.png/v1/fill/w_1000,h_261,al_c,usm_0.66_1.00_0.01/f8aa5d_b78e0bd012744891a645d6ded4f19e91~mv2.png)

Still, some small-business owners might not have realized that they get approved for the 2021 credit, and they have up to three years from their original filing deadline to retroactively declare the credit. Normally, employers were eligible to declare the ERTC if their company operations were suspended in 2020 or 2021.

For 2021, however, businesses might certify if their profits declined by only 20% when compared to the very same quarter in 2019. Under the original law, employers were not eligible for the ERTC if they likewise got a Paycheck Defense Program (PPP) loan. That guideline was later on removed, so that services that got PPP loans could also take benefit of the ERTC (nevertheless, if PPP loan profits utilized to pay earnings were forgiven, those salaries were not qualified for the ERTC).

Originally, the credit was topped at 50% for up to $10,000 in salaries (so, $5,000 per employee). In 2021, the amount was expanded so that companies might declare as much as $7,000 per staff member per quarter (up to $21,000 total in 2021). Many companies have also been puzzled about the guidelines for working workers.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act supplied a chance for companies to produce a refundable tax credit used to offset their work taxes and make an application for a refund for any excess credit generated through December 31, 2020. The COVID-19-related Tax Relief Act of 2020 further extended the Worker Retention Tax Credit (ERTC) through June 30, 2021.